Turkish Economists' Work Is Recognized

Recently the Journal of Political Economy (JPE), probably the most prominent journal in economics, published a retrospective issue to celebrate its 125th anniversary: The Past, Present, and Future of Economics: A Celebration of the 125-Year Anniversary of the JPE and of Chicago Economics. The senior faculty at the Department of Economics and Booth School of Business were asked to contribute to this collection of essays by pointing to a few key papers, in selected areas, published in the JPE as a way of celebrating the influence of this journal in their fields. The earliest reference in this issue dates back to 1817!

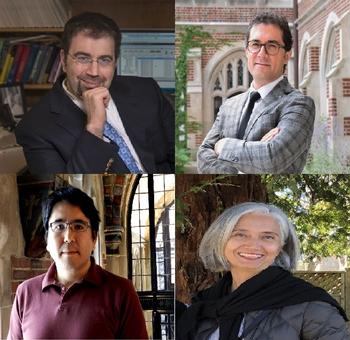

Two Turkish economists, Ufuk Akcigit and Ali Hortacsu, who are faculty members at the University of Chicago, contributed to the issue and research by three Turkish economists, Daron Acemoglu, Ufuk Akcigit, and Ayse Imrohoroglu, were discussed at length.

Daron Acemoglu’s 2012 book “Why Nations Fail” (joint with James Robinson) was summarized as an important contribution in the area of Economic History. This book highlights the importance of political institutions as the key determinant of the long-run economic success or failure of nations as opposed to traditional arguments such as geographical differences, culture or the ignorance of the leaders. They show that, throughout the history, countries that are ruled by narrow elites who have organized the society for their own benefits have remained behind. These elites formed extractive institutions – institutions that were designed to extract incomes and wealth from one subset of society to benefit a different subset - leading to poor economic outcomes. Societies that formed inclusive economic institutions, on the other hand, paved the way for inclusive markets, which focused on productivity, education, technological advances and the well being of the entire nation instead of the few elites.

Also, Daron Acemoglu’s 2005 paper with Simon Johnson, “Unbundling Institutions.” was cited as an outstanding example illustrating how political institutions affect the performance of economic markets themselves. In this paper, they delve deeper into understanding the relative roles of different types of institutions. Using data from nations that were formerly European colonies, they show that countries with greater constraints on politicians and elites and more protection against expropriation by these powerful groups have experienced substantially higher long-run economic growth, investment and financial development.

Ufuk Akcigit’s 2016 paper joint with Hanley, and Serrano-Velarde, “Back to Basics: Basic Research Spillovers, Innovation Policy and Growth,” and his forthcoming paper with Kerr, “Growth through Heterogeneous Innovations.” were cited for their contributions to innovation-based economic growth. These papers are fundamentally interested in understanding and fostering economic growth. In the 2016 paper, they show the importance of “basic research” on economic growth and inefficiencies that occur due to misallocation of resources to “applied research.” In the forthcoming paper, they examine innovation and growth patterns of different-sized firms and their contributions to macroeconomic growth more closely. They find that small firms are expanding disproportionately more effort to innovations that help them obtain technology leadership over products not currently owned, and the spillovers associated with such innovations are significant. Their findings suggest that R&D policies that aim to correct for underinvestment in R&D should take into account the differential spillovers generated by different-sized firms in the economy.

Ayse Imrohoroglu’s 1989 paper, “Cost of Business Cycles with Indivisibilities and Liquidity Constraints,” was summarized as one of the six important papers in the area of “Inequality, Heterogeneity, and Consumption.” This paper was one of the early papers that opened the door for fully-fledged macroeconomics models of inequality. It was motivated by a famous paper by Lucas (1989) who had shown that the welfare costs of business cycles were small. His exercise was carried out in a framework that abstracted from differences in individuals in terms of their employment or income levels. Ayse’s paper introduced income shocks and borrowing constraints, which meant that individuals facing different shocks might be hurt differently from business cycles. Her results indicate that the welfare cost of business cycles can be four times higher as a result of this heterogeneity. But, more importantly, this paper helped pave the way towards models with heterogeneous agents instead of the representative agent framework that was the common framework used previously.

We congratulate them for their contributions and the recognition they received.

References

Acemoglu, Daron, and James Robinson. 2012. Why Nations Fail: The Origins of

Power, Prosperity, and Poverty. New York: Crown Bus.

Acemoglu, Daron, and Simon Johnson. 2005. “Unbundling Institutions.” J.P.E.

113 (5): 949–95.

Akcigit, U., D. Hanley, and N. Serrano-Velarde. 2016. “Back to Basics: Basic Research Spillovers, Innovation Policy and Growth.” Discussion Paper no. 11707,

Centre Econ. Policy Res., London.

Akcigit, U., and W. R. Kerr. Forthcoming. “Growth through Heterogeneous Innovations.” J.P.E

Imrohoroglu, Ayse. 1989. “Cost of Business Cycles with Indivisibilities and Liquidity

Constraints.” J.P.E. 97 (6).